Don’t Wait! Begin clearing your Tax Problems right away.

Tax issues damage many individuals and businesses throughout Southern California and the U.S. both financially and psychologically. Emil Estafanous, CPA has represented many clients in solving their IRS problems. It is important not to ignore any correspondence and inquires from the IRS, EDD, Franchise Tax Board, and/or State Board of Equalization. The longer you wait to resolve your tax problems the less money you might have to pay in taxes to resolve your tax problems. Many taxpayers underestimate the rights they are entitled to when dealing with the IRS. The Accounting and Tax Firm of Emil Estafanous, CPA is familiar with the way the IRS operates and can utilize the tax law in your favor.

Tax problems do not just arise with the IRS. Chances are if you have IRS tax issues, you are experiencing State Tax problems as well, which complicates the situation. Emil Estafanous, CPA has also assisted many taxpayers in resolving State Tax Problems. As a Certified Public Accountant (CPA) specialized in tax problems and solutions, Emil Estafanous will help you get a fresh start.

Call the Certified Public Accountant Tax Specialist, Emil Estafanous to start your tax settlement analysis at (800) 905-1547

about us.

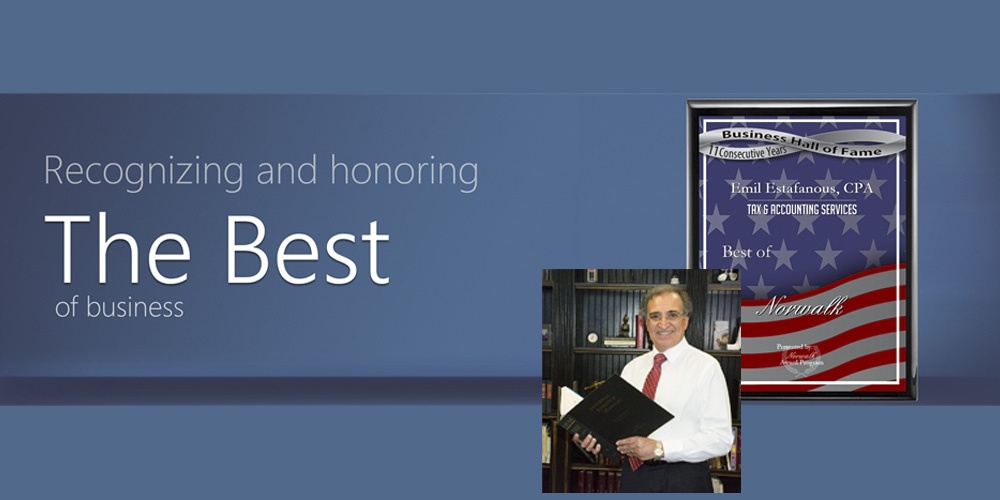

The Accounting office of Emil Estafanous, CPA has helped clients expand their businesses and achieve financial security for more than 25 years. Along with helping business owners with mergers, acquisitions, or the sale of their business, Emil is also a business and financial adviser to clients in a variety of industries such as but not limited to: trucking, manufacturing, service, retail, real estate, attorneys, physicians…etc.

Emil uses his experience and expertise in setting up new businesses for his clients, helping businesses run more effectively and efficiently, and lowering their taxes through clever tax planning. He also has a long work history in reviewing corporate, partnership, and individual tax returns. As a Forensic CPA, he utilizes his accounting, auditing, and investigative skills to determine what events actually took place in any given financial setting… Read more

Allow a tax accountant specialized in resolving Tax Debts to solve your tax problems and prevent dreadful tax consequences.

When you owe taxes, the IRS and State Agencies can take the following actions against you:

Levy:

Seizing of your bank account(s) and any assets you may posses to fulfill your tax liability.

Penalties and Interest:

Inflicted penalties and interest will accrue and result in a debt increase.

Garnishment:

Your employer can be ordered to withhold a portion of your wages and other income from your paycheck.

Confiscation of Retirement Accounts:

Collection against your 401(k) and other retirement accounts will be enforced. Even your social security retirement is not immune from being withheld.

Lien:

Will prevent you from from exchanging, selling or transferring any property. In addition, this will negatively impact your credit report.

The Tax and Accounting Firm of Emil Estafanous, CPA will negotiate on your behalf and help you reconcile your tax problems.

Tax Problem Resolutions Services offered by an experienced Certified Public Accountant and Tax Specialist

Protect yourself, your home, paycheck, bank account(s), and assets from collections due to tax problems. As your Tax Representative, Emil Estafanous will interview you and assess the best approach to resolve your issues with tax debt. There are several way for taxpayers to achieve tax relief. Helping eliminate your tax liability by negotiated settlements has relieved many clients from their tax problems.

When dealing with taxing authorities and in order to accomplish tax relief the following options are available for taxpayers with tax problems:

- Tax Relief

- Offer in Compromise

- Tax Amnesty

- Taxpayer Advocate

- Due Process

- Injured Spouse Relief

- Installment Agreement

- Collection Appeals

- Tax Court

These tax methods among others can be vital to the success of eliminating tax problems. As your tax problem solver, Emil Estafanous, CPA will supply you with the necessary tools to resolve your tax debt.

03

Our team.

We understand your requirement and provide quality works.

Daniele Johnson

Founder & CEO

Summer Geller

CTO

Marissa Adams

Lead Developer

Jennifer Gilmore

Marketing

12,458+

Projects Completed

1,796+

Satisfied Clients

1,000+

Positive Feedbacks

1,500+

Freebies Released

Our Works

The Accounting office of Emil Estafanous, CPA has helped clients expand their businesses and achieve financial security for more than 25 years. Along with helping business owners with mergers, acquisitions, or the sale of their business, Emil is also a business and financial adviser to clients in a variety of industries such as but not limited to:

Trucking

Manufacturing

Real Estate

Attorneys

etc...

05

Pricing Table.

We understand your requirement and provide quality works.

Starter

$125

Per Month

- 800GB Online Storage

- 20 Files Per Day

- 2TB Monthly Bandwidth

- Secure Platform

- Fast & Reliable

- 24/7 Customer Support

Starter

$125

Per Month

- 800GB Online Storage

- 20 Files Per Day

- 2TB Monthly Bandwidth

- Secure Platform

- Fast & Reliable

- 24/7 Customer Support

Starter

$125

Per Month

- 800GB Online Storage

- 20 Files Per Day

- 2TB Monthly Bandwidth

- Secure Platform

- Fast & Reliable

- 24/7 Customer Support

Testimonials.

Emil helps with all aspects of my business:

“For doctors, the issue of incorporation is more than dealing with the IRS. Emil has been extremely helpful in assisting me with everything, including the application with the state. He also helps me with general business issues, including things I need to consider with telecommunications, billing services and more.”

Haydee C., MD

Why Select Us?

We understand your requirement and provide quality works.

Incorporating

Incorporating your business can provide you with several benefits. For example you can protect your assets, establish a professional identity, and save money on taxes among other advantages.

Tax

Preparation

Preparation

Preparing your own income tax return can be a task that leaves you with more questions than answers. According to a study released by the US Government’s General Accounting Office

Business

Planning

Planning

A Strategic Business Plan is much more than a tool to obtain financing. If you still have all you plans and ideas locked up inside your head…

Business

Accounting

Accounting

As a small business owner you have more important things to do than to keep your own books. We take care of your books for you, so you can get back to the job of running your business and generating profits!

Payroll

When it comes to paying employees, laws and the IRS have made the payroll function a time consuming nightmare for the small business owner.

Tax

Planning

Planning

Planning is the key to successfully and legally reducing your tax liability. We go beyond tax compliance and proactively recommend tax saving strategies to maximize your after-tax income.

Start your journey with us now

Our Blog

Here are some of the key tax-related deadlines affecting businesses and other employers during the fourth quarter of 2024. Keep in mind that this list isn’t all-inclusive, so there may be additional deadlines that…

Help ensure your partnership or LLC complies with tax law

September 21, 2024

When drafting partnership and LLC operating agreements, various tax issues must be addressed. This is also true of multi-member LLCs that are treated as partnerships for tax purposes. Here are some critical issues to…

Emil @ CPA-LA tips: It’s time for your small business to think about year-end tax planning

September 12, 2024

With Labor Day in the rearview mirror, it’s time to take proactive steps that may help lower your small business’s taxes for this year and next. The strategy of deferring income and accelerating deductions…