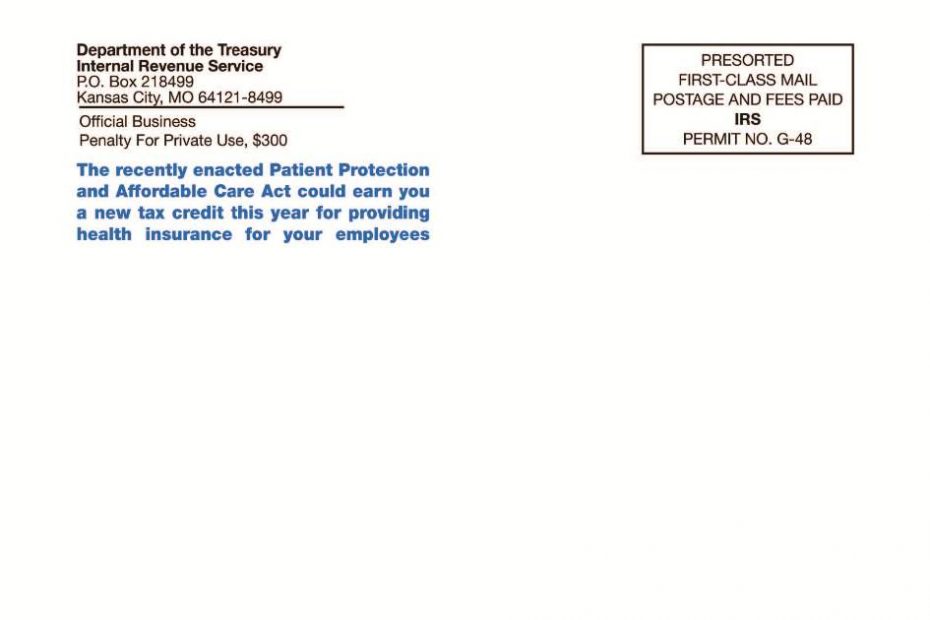

Health care credit for businesses

The IRS has issued guidance to help small business owners cope with new requirements in the monumental health care legislation. (IR-2010-38) Under the new health care law, a small business is eligible for credit for… Read More »Health care credit for businesses